UK Travel Insurance: Do You Need It?

Travel insurance is a prudent precaution against unforeseen costs, even though it is not legally required for visitors to the UK. Without coverage, minor accidents, lost luggage, medical emergencies, and even cancelled flights can become expensive. Although it is not required, a decent travel policy for holders of UK ETA and visas guarantees 24/7 help and financial protection, allowing you to travel with security and confidence.

Who needs travel insurance for the UK?

Anybody, regardless of age or nationality, who is visiting the UK should think about purchasing travel insurance. Here are some things to think about:

- Age: Although travel insurance is necessary for everyone, older travellers (usually those who are 65 and older) may be subject to higher rates or certain policy limitations.

- Health conditions: Insurance options and costs may be impacted by pre-existing medical illnesses, such as diabetes, heart disease, or respiratory disorders.

- Trip type and duration: Specialised coverage may be necessary for longer journeys, adventure sports (such as hiking or skiing), or travelling to isolated locations.

- Activities: Extra premiums may be needed for some activities, including extreme sports.

Some groups that might particularly benefit from travel insurance include:

- Seniors (65+)

- Young travelers (under 25) traveling alone

- Families with young children

- Adventure seekers

- Travelers with pre-existing medical conditions

When choosing a policy, consider factors like:

- Medical coverage

- Trip cancellations or interruptions

- Lost or stolen luggage

- Travel delays

- Personal liability

Advantages of having Travel Insurance for a UK Trip

Although visiting the United Kingdom (UK) can be an exciting trip, it is important to be ready for everything that might come up. Having UK travel insurance is one method to safeguard both your trip and yourself. Although having travel insurance is not mandatory, it is strongly advised to secure a UK visa. Let's examine the importance of travel insurance when visiting the UK.

Remember

➽ The terms and conditions specified in the travel insurance policy apply to all filed claims.

Medical Emergencies

Although nobody intends to become ill or hurt when travelling, mishaps sometimes occur. International visitors to the UK are not entitled to free healthcare services, and medical costs might be considerable. If you require medical attention while travelling, having medically covered travel insurance can guarantee that you will have access to high-quality medical care and financial support. It pays for things like emergency medical evacuation, prescription drugs, doctor visits, and hospital stays.

Trip Cancellation or Interruption

Unexpected events can occasionally compel you to postpone or cancel your vacation to the UK. A personal emergency, illness, natural calamity, or even a travel advisory from your native nation could be the cause. You risk losing a sizable amount of your prepaid costs, such as reservations for flights, lodging, and tours, if you do not have travel insurance. Travel insurance that covers cancellation of trip or interruption reimburses you for these non-refundable expenses to shield you from monetary loss.

Lost Baggage or Personal Belongings

Imagine discovering that your luggage has been delayed or missing when you arrive in the UK. Travel plans may be disrupted and inconvenienced. Protection against misplaced, pilfered, or destroyed personal belongings and luggage is provided by travel insurance that includes baggage coverage. It offers compensation to help replace necessities like clothing, toiletries, and other possessions if such an incident occurs during your trip.

Delays and Cancellations of Flights

Disruptions to flights are frequent and cause annoyance and irritation. Travel insurance provides financial protection in such circumstances, including coverage for airline delays and cancellations. It covers additional costs, such as lodging, meals, transportation, and even other flight arrangements, that arise from airline delays or cancellations. You can lessen any financial strain that unforeseen flight changes may bring and handle them more easily with this coverage.

Peace of Mind

The most significant advantage of purchasing travel insurance is peace of mind. You can unwind and enjoy your vacation without worrying about unanticipated circumstances when you have travel insurance. You can concentrate on touring the UK and making lifelong memories, knowing that you are financially covered against medical crises, trip cancellations, lost luggage, or flight problems.

Cost Range for Travel Insurance to the UK

When choosing an appropriate coverage, the price of UK travel insurance is an important consideration. Keep in mind that the following variables affect how much your travel insurance plan costs:

- Duration of the Trip: The length of your trip determines how much UK travel insurance costs. This implies that your insurance rates will be higher for longer stays and lower for shorter journeys.

- Plan Type: The cost of UK travel insurance is also determined by the type of plan and the quantity of coverage. For instance, because of shared coverage, family and group travel insurance policies are less expensive than individual insurance plans.

- Coverage Amount: Your chosen sum of coverage also determines the cost of your travel insurance. Keep in mind that premiums increase with the amount insured and vice versa. Additionally, it will guarantee more thorough and superior coverage.

- Additional Prerequisites: In addition to the previously listed factors, the cost of your UK travel insurance also varies according to the extra coverage you need from different riders and add-ons.

How Can I Purchase the Best UK Travel Insurance?

- Choose Adequate Coverage: Describe your needs for coverage depending on variables such as the length of the trip, the number of passengers, age, health, possible hazards, and so forth. You can choose a sufficient amount of insurance and comprehensive coverage based on these factors.

- Examine various plans: The easiest approach to find the best insurance for the UK is to compare travel insurance. Examine several plans according to criteria, including coverage type, premium, claims settlement, inclusions and exclusions, etc.

- Work with a Trustworthy Supplier: Purchase your travel insurance from a reputable insurance company at all times. Additionally, confirm that their plans are generally accepted in the foreign country you are visiting.

- Ensure a Smooth Settlement of Claims: For hassle-free reimbursement in the event of claims, look for emergency claims help and a simple claims settlement procedure.

- Purchase Online: Consider buying your policy online if you are searching for inexpensive or reasonably priced travel insurance for the UK. You can qualify for exclusive offers and savings on internet shopping.

How to Claim UK Travel Insurance?

Depending on your service provider, the procedure for filing a claim for UK travel insurance may differ. Here is a typical step-by-step approach, though:

Step 1: Notify your insurer: Inform your insurance provider as soon as possible after the incident.

Step 2: Gather documents: Collect relevant documents, such as:

- ☑ Police reports (for theft or loss)

- ☑ Medical certificates (for illness or injury)

- ☑ Receipts (for expenses or losses)

- ☑ Travel itinerary and tickets

Step 3: Fill out the claim Form: Complete the claim form provided by your insurer, either online or by mail.

Step 4: Submit Claim: Send the completed form and supporting documents to your insurer.

Step 5: Wait for Assessment: The insurer will review your claim and may request additional information.

Step 6: Claim Decision: The insurer will inform you of their decision and any payout or next steps.

Additional Tips:

- Keep records of all correspondence with your insurer.

- Check your policy documents for specific claim requirements.

- Contact your insurer's claims department for guidance.

- Remember to check with your service provider for their specific claims process, as it may differ.

Tips for Precautions and Safety in the UK

Tip No. 1: Keep Emergency Contacts Handy: Maintain a convenient list of all emergency numbers, including police, fire, and medical. Additionally, it is a beneficial idea to have the phone numbers of your friends and coworkers in the UK handy in case of an emergency.

Tip No. 2: Secure Your Belongings: Keep your belongings, such as travel documents, a mobile phone, and any other items, secure. If possible, avoid carrying expensive items, such as jewellery, when travelling.

Tip No. 3: Buy UK Travel Insurance: Purchase travel insurance for UK trips to cover your unplanned expenses that may arise due to medical or other inconvenient scenarios during your journey.

Tip No. 4: Be Prepared for Weather: Weather can be very unpredictable in the United Kingdom. Hence, plan and pack accordingly. Stay Updated: During your entire stay in the UK, make sure to stay updated regarding immigration laws, weather changes, travel restrictions and anything that concerns you.

Tip No. 5: Experience the best of the UK with these top destinations: London, Edinburgh, Scottish Highlands, Isle of Skye, Liverpool, York, Manchester, Lake District, Belfast, Glasgow, Snowdonia National Park, Loch Ness, Newcastle Upon Tyne, Birmingham, and The Giant's Causeway. Explore vibrant cities, breathtaking natural landscapes, and iconic landmarks, immersing yourself in the rich history, culture, and beauty of the United Kingdom.

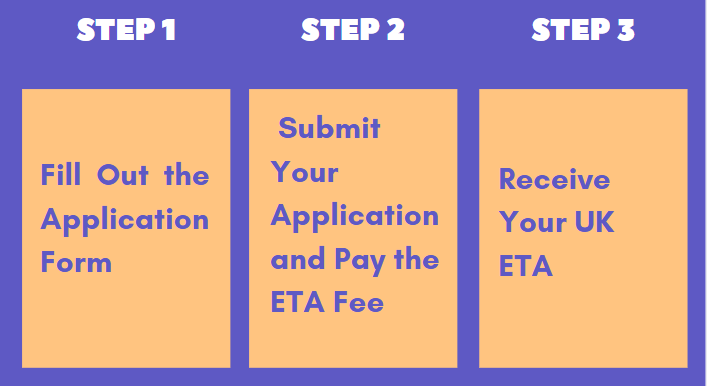

Application Process of the UK ETA

The UK ETA application process involves the following steps:

Step 1: Fill Out the Application Form: Complete the UK ETA Application Form with accurate and thorough information, including:

- Personal details

- Passport information

- Travel plans

Once the application is filled out correctly, upload the Documents Required for the UK ETA.

Step 2: Submit Your Application and Pay the ETA Fee: Submit the completed form and pay the required fee. You will receive a confirmation of receipt.

Step 3: Receive Your ETA: Upon approval, receive your UK ETA via email or through the application portal. Make sure to:

- Check the validity period

- Understand the terms and conditions

Additional Tips

- Apply in advance to avoid delays

- Ensure accurate information to prevent application issues

- Check the UK ETA website for the most up-to-date information

By following these steps, you can efficiently obtain your UK ETA and prepare for your trip.

UK Travel Checklist

- Documents: Carry necessary travel documents such as a passport, visa or ETA, medical reports, UK travel insurance, ID proof, etc. To add an extra layer of safety, carry all the documents in a digital format as well.

- Clothing and Accessories: Only pack essential items after checking the weather conditions during your stay in the country. Make sure to leave some room for your vacation shopping.

- Electronics: Make sure to carry your electronics safely in their protective covers. These include your mobile phone, camera, laptop, adapters, etc.

- Accommodations and Transportation: Make sure to book your accommodations and transportation in advance to avoid any last-minute rush. The same applies to renting a four-wheeler during your stay in the UK.

- Local Currency: Have your currency exchanged to British Pounds (GBP). Also, learn about options for global credit and debit card transactions from your bank or financial services provider.

Do refer to:

How to Travel the UK on a Budget?

Conclusion

Travelling to the UK can be wonderful, but you must be prepared for the unexpected. With travel insurance, you can relax and enjoy your vacation. Good insurance can protect you from medical crises, travel cancellations, lost luggage, and flight disruptions, helping you enjoy your time in the UK. Before you leave, explore your options and pick an insurance that fits your needs. Indeed, a worry-free journey is happier!

Most Common Queries Related to UK Travel Insurance

- What's the difference between travel insurance and health insurance?

Travel insurance covers unexpected events like trip cancellations, lost luggage, and medical emergencies while traveling, whereas health insurance typically covers medical expenses in your home country.

- Can I buy travel insurance if I have a pre-existing medical condition?

Yes, but you might need to pay a higher premium or purchase a specialized policy. Be honest about your condition when applying, as failure to disclose could void your policy.

- Will my travel insurance cover me for adventure activities like skydiving or bungee jumping?

Not always. Many standard policies exclude high-risk activities. Check your policy's fine print or consider purchasing additional coverage for adventure sports.

- Can I extend my travel insurance if I decide to stay longer in the UK?

It depends on your provider. Some insurers allow extensions, while others might require you to purchase a new policy. Check with your insurer before your trip.

- What if I lose my passport and travel documents while in the UK?

Contact your country's embassy or consulate for assistance. Some travel insurance policies may cover replacement costs or provide emergency funds.

- Are there any exclusions I should be aware of in travel insurance policies?

Yes, common exclusions include pre-existing medical conditions (if not declared), high-risk activities, acts of terrorism, and natural disasters. Always read the fine print.

- Can I purchase travel insurance for a one-way trip to the UK?

Yes, some insurers offer one-way trip policies. However, these might be more expensive than standard policies. Shop around to find the best option.

- How do I know if my travel insurance policy is valid in the UK?

Check your policy documents or contact your insurer to confirm coverage in the UK. Ensure your policy is accepted in the UK and covers your specific needs.

Steps to Secure Your eTA for the United Kingdom

- Step1: Complete the online application form by entering your passport details and required personal information.

- Step2: Make the payment securely online using a credit or debit card.

- Step3: Check your email for the payment confirmation and receive your eTA electronically.