Global Airlines UK Gains Backing from Knighthood

UK-based long-haul airline start-up Global Airlines has taken a major step forward in its growth journey by welcoming Knighthood Global, a leading consultancy and investment firm, as a strategic investor and advisor. The deal is expected to accelerate Global Airlines’ ambitions to become a notable transatlantic carrier with a fleet of Airbus A380 aircraft.

Strategic Partnership with Aviation Veterans

Knighthood Global is led by former Etihad Airways CEO with Etihad’s former CFO, also onboard. Both will now serve as strategic advisers to Global Airlines. Their appointment brings decades of aviation industry experience, particularly in high-level operations, financing, and strategic planning.

According to Knighthood’s official statement, the firm will take a shareholder stake in Global Airlines and provide "key strategic advice and support" during its critical early phase of development. One of its main focuses will be to guide the airline through its UK Air Operator’s Certificate (AOC) application process — a requirement before the airline can operate regular scheduled services.

Upcoming Flights and Operations

Although Global Airlines has yet to obtain a UK AOC or an operating licence, it plans to launch its first two transatlantic return charter flights in May 2025. These include:

- Glasgow to New York JFK on May 15, returning on May 19

- Manchester to New York JFK on May 21, returning on May 25

All four flights will be conducted on board an Airbus A380-800 registered 9H-GLOBAL, a 12.6-year-old aircraft owned by Global Airlines and operated under charter by Hi Fly Malta. The aircraft underwent cabin refurbishment, though not a full reconfiguration, in preparation for the flights.

Tickets are being sold through Travelopedia, a British tour operator, and the flights are being treated as full charter services rather than commercial scheduled flights.

Company Background and Ownership

Global Airlines was founded by a travel tech entrepreneur who is also known for his Holiday Swap platform. The airline aims to revive large aircraft use in long-haul travel, specifically focusing on the A380 — a model that many carriers have retired in recent years due to high operating costs.

Global Airlines is primarily owned by Ihtg Limited, which holds over 75% of the shares. Ihtg is in turn controlled by Asquith. The company's ambitious long-term plan involves adding more A380s to its fleet in 2025 and eventually launching regular scheduled services between the UK and the US.

Knighthood Global’s Track Record

Knighthood Global has a mixed but influential history in airline restructuring and investment. It played a central role in Etihad Airways’ past expansion strategy, which involved investments in carriers such as Alitalia, Air Berlin, and Jet Airways — all of which have since ceased operations. Following these outcomes, Etihad underwent significant restructuring. More recently, Knighthood advised the Maltese government on winding down Air Malta and launching its successor, KM Malta Airlines. The firm also consulted the Estonian government on Nordica, which was eventually shut down.

Potential Implications for Global Airlines

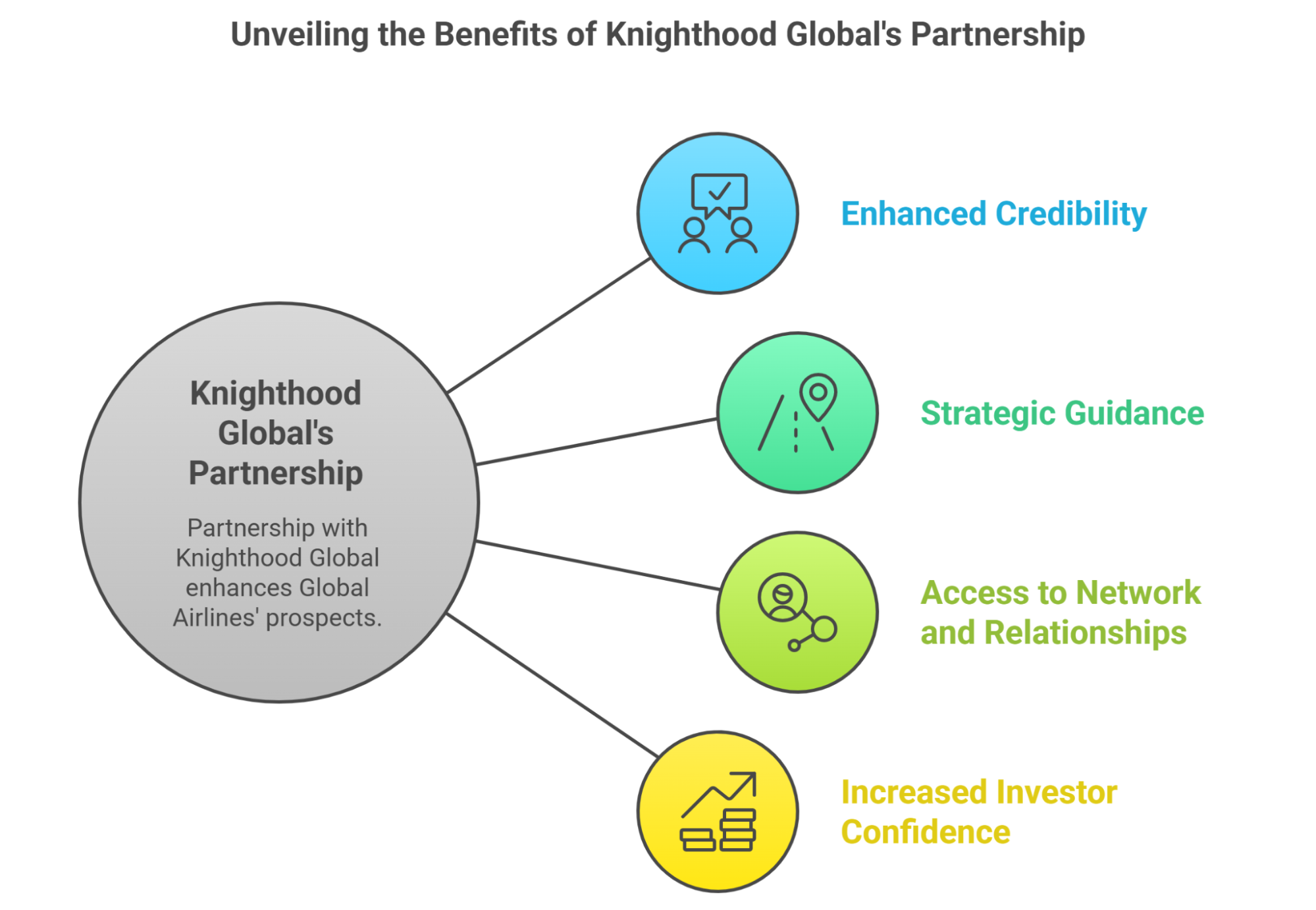

The partnership with Knighthood Global carries several potential benefits for the UK-based airline:

- Enhanced Credibility: The backing of a firm led by a seasoned aviation veteran like James Hogan lends significant credibility to Global Airlines, potentially easing negotiations with suppliers, regulators, and partners.

- Strategic Guidance: Knighthood Global's expertise can provide invaluable guidance on route selection, operational efficiency, customer experience, and overall business strategy.

- Access to Network and Relationships: Hogan's extensive network within the aviation industry could open doors for strategic partnerships and collaborations.

- Increased Investor Confidence: The involvement of Knighthood Global may attract further investment and support from other financial institutions and stakeholders.

Potential Implications for the Aviation Industry

The entry and potential success of Global Airlines, bolstered by Knighthood Global's investment, could have broader implications for the aviation industry:

- Increased Competition on Long-Haul Routes: Global Airlines' focus on transatlantic routes could intensify competition, potentially leading to more competitive pricing and service offerings for travelers.

- Revival of the Full-Service Model: If Global Airlines succeeds in its vision, it could signal a renewed interest in the full-service, long-haul experience, potentially influencing the strategies of other airlines.

- Impact on Airbus A380 Operations: As one of the few airlines committed to operating the A380, Global Airlines' success could provide a positive outlook for the future of this iconic aircraft.

- Job Creation in the UK: The growth of Global Airlines will likely lead to the creation of numerous jobs in the UK, spanning flight crew, ground staff, and administrative roles.

What Does This Mean for Travelers?

For passengers, the investment in Global Airlines could translate to:

- Potential for More Choice: A new entrant in the long-haul market offers travelers another option for transatlantic journeys.

- Focus on Passenger Experience: Global Airlines' stated commitment to a premium service model could lead to a more comfortable and enjoyable flying experience.

- Competitive Fares: Increased competition on key routes could potentially result in more attractive fares.

- Return of the A380 Experience: For aviation enthusiasts and those who appreciate the spaciousness of the A380, Global Airlines offers a chance to fly on this iconic aircraft.

A Cautiously Ambitious Future

Global Airlines’ decision to work with Knighthood Global reflects its commitment to experienced leadership and long-term strategy. While the airline has faced skepticism due to its high-profile aircraft and lack of regulatory approvals, the involvement of seasoned professionals may help transform its vision into reality.

With test flights underway and transatlantic services on the horizon, the partnership with Knighthood marks a crucial turning point. If successful, Global Airlines could become one of the very few operators to reintroduce the A380 into regular long-haul service — a bold move in an industry increasingly driven by fuel efficiency and smaller wide-body jets.

Steps to Secure Your eTA for the United Kingdom

- Step1: Complete the online application form by entering your passport details and required personal information.

- Step2: Make the payment securely online using a credit or debit card.

- Step3: Check your email for the payment confirmation and receive your eTA electronically.